NRMA Saftey Hub

Paying people to reduce their risk of disaster.

Challenge

Insurance, by its very nature, operates reactively. Customers pay premiums for years, yet the only tangible benefit often arrives after a devastating, high-stress event like a house fire, flood, or accident. This transactional relationship leads to low customer engagement, feelings of being undervalued, and a perception of the insurer as merely a claims processor.

The core challenge was two-fold:

- Financial Risk Reduction: Claims payouts represent significant financial losses. NRMA sought an innovative way to proactively reduce household risk factors at scale, directly mitigating potential future claims costs.

- Customer Perception and Loyalty: In a competitive market, NRMA needed to deliver tangible, sustained value that fostered loyalty, increased positive sentiment, and demonstrated genuine care beyond policy renewal cycles. The goal was to prove that NRMA valued prevention as much as protection.

Solution

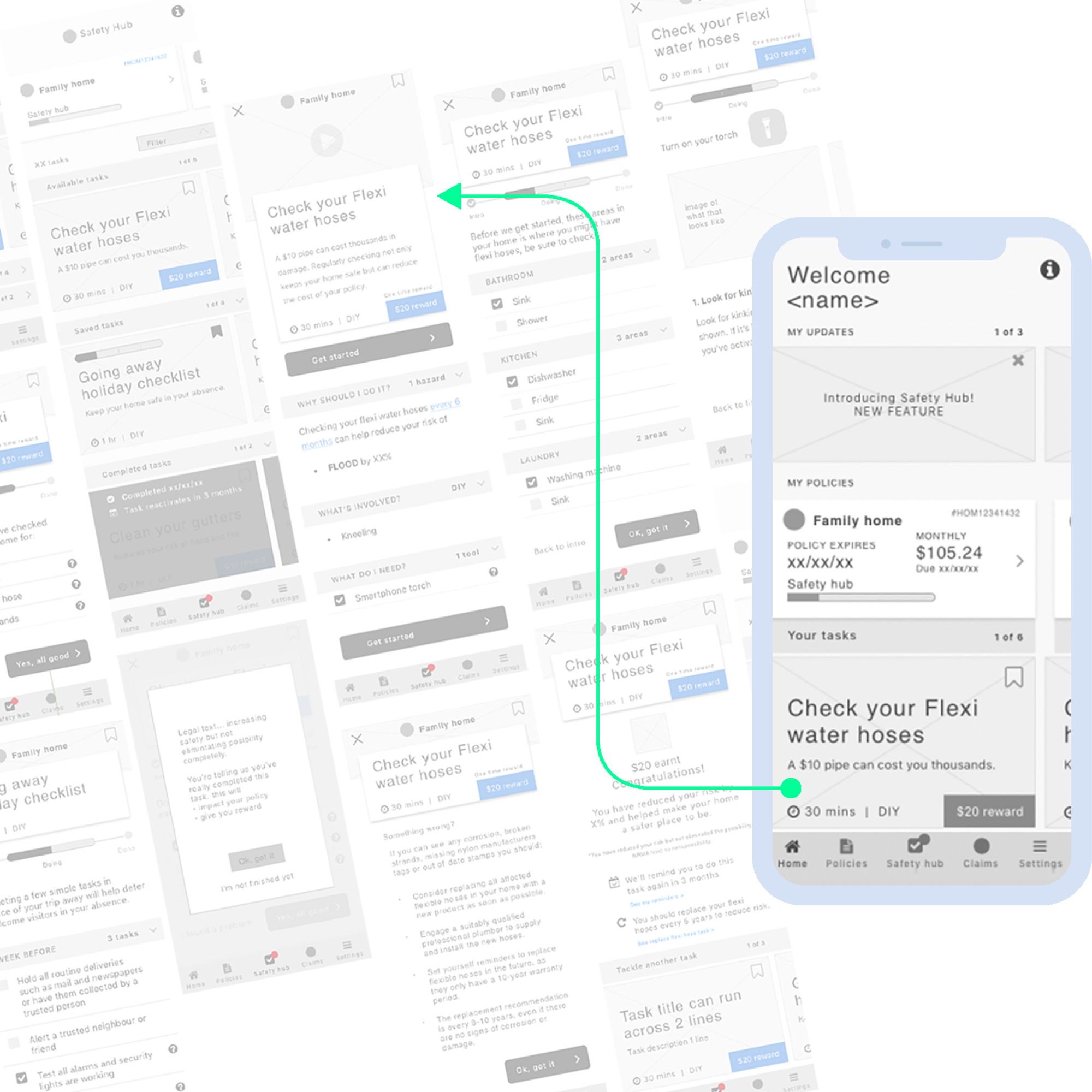

The NRMA Safety Hub App fundamentally shifted the insurance model by redirecting claims money and policy loyalty rewards toward proactive risk prevention. Built on a gamified, behavior-changing design, the platform uses defined tasks to guide customers through simple, high-impact maintenance actions such as clearing gutters or replacing common failure points like flexible hoses.

Results

- 4,500 tasks completed by the initial user group

- 97% of users viewed NRMA as a more proactive insurer (compared to 79% cited in the original brief), indicating a significant shift in brand perception

- 83% of users felt more valued by NRMA (compared to 62% cited in the original brief), strengthening the emotional bond with the brand

- 79% of users were more likely to recommend NRMA, signaling high advocacy potential

- The NRMA Safety Hub was recognised as the Most Awarded App globally in 2021

See something you like?

Let's talk.

88 Chapel St.

Windsor, VIC 3181

Email me

Connect on LinkedIn

Instagram

Copyright © 2026 Trent Roberts